The Annual Reporting requirement is part of the new reporting requirements that the QBCC introduced in the 1 April 2019 legalisation changes.

The Annual Report

The Annual Report asks each licensee to provide the QBCC with Financial Information (essential profit & loss and balance sheet information) from the most recent financial year – for most licensees this will be the prior 30 June.

The amount of information that you need to provide will depend on which type of license you hold:

- Self-disclosing category 1 – turnover up to $200,000

- Self-disclosing category 2 – turnover up to $870,000

- Category 1 – turnover up to $3,000,000

- Category 2 – turnover up to $12,000,000

- Category 3 – turnover up to $30,000,000

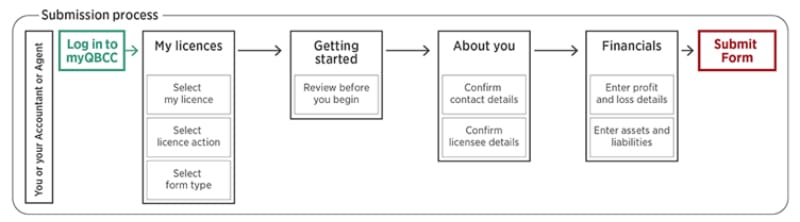

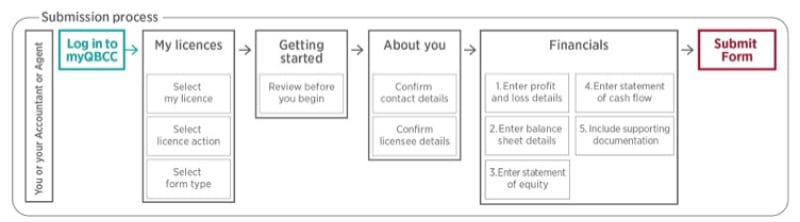

How to lodge

Self-disclosing categories 1 & 2

We have spoken with the QBCC, they have confirmed that the Financials can be directly from your accounting software. We encourage you to be cautious as they must still meet the minimum financial requirements under your license.

Categories 1,2 & 3

If your license is under these categories, it is likely that you will require our assistance to prepare the Financial Information as you must lodge A Statement of Cash Flow & Statement of Equity which are generally unavailable directly from your Accounting software.

Annual Reporting versus Minimum Financial Requirements

At a basic level the Annual Reporting will provide the QBCC with access to your revenue, expenses, assets and liabilities which will allow the QBCC to determine if you hold more enough Net Tangible Assets at the end of the financial year.

This will also allow the QBCC to focus on licensees who do not hold enough to match their turnover, providing them with a grace period of up to 31 December 2020 to strengthen up their asset position.

We will send more information about this in the next few months.

How we can help

We recommend that you allow us to assist with lodging your Annual Report, this is easily done by adding your Accountant as a nominated representative under myQBCC:

Add a nominated representative:

- Select “My Licences” at the top of account login page

- Click “Action” tab to the left of the licence you are granting access to

- Select “Add a new representative”

- Enter the representative details:

- Chris Henman – 0404 935 495

- Dean Coram – 0421 866 831

[email protected] [email protected]

- Click submit to access the Manage Permissions page

- Locate the newly added representative and click ‘enable’ to grant permission to access myQBCC

Or by calling QBCC directly on 139 333.

We are always here to help if you have any more questions on your QBCC reporting requirements, please feel free to call your Accounting team on 07 5593 6060.